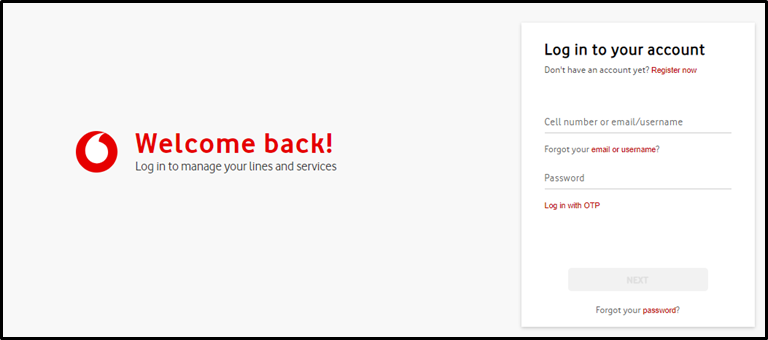

STEP 1

Log in to your account on the Vodacom Portal by clicking here. If you have not yet registered on the Vodacom Portal, you will need to first register an account.

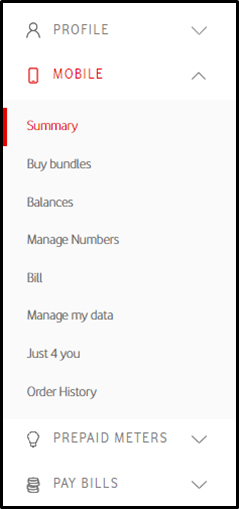

STEP 2

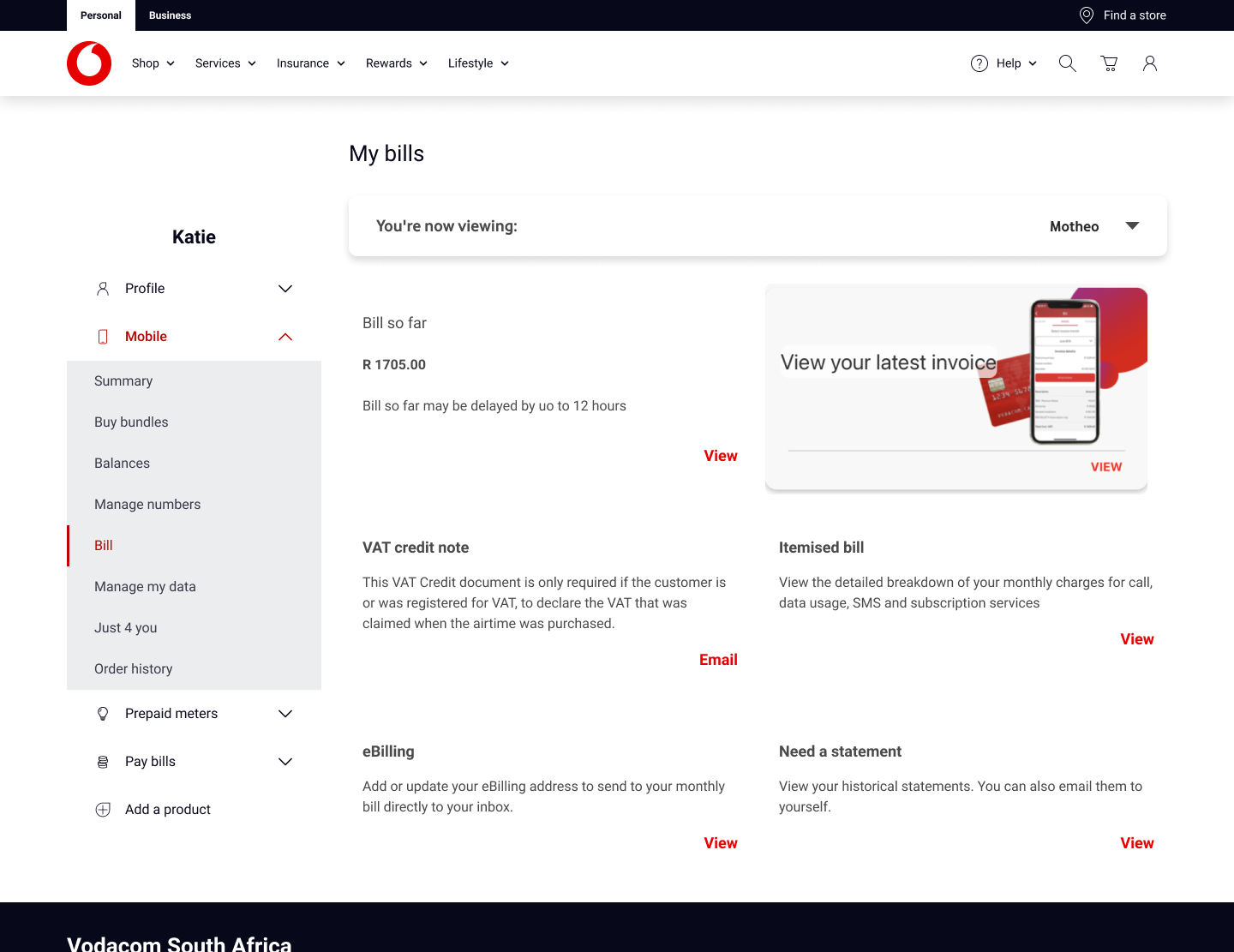

Once logged in, select 'Bill' from the navigation panel on the left.

STEP 3

Select 'VAT credit note' from the panel which will then show you if you have a VAT credit/debit note available. If you do, click on 'Email'.

STEP 4

NOTE:

1. VAT Registered Hybrid/Top-up customer with a VAT Registration number on file with Vodacom to please note the following:

If you have provided Vodacom with your address and VAT Registration, these details will be displayed on your VAT Credit/Debit note.

If your address has changed you will have to contact Customer Care or visit a Vodacom store.

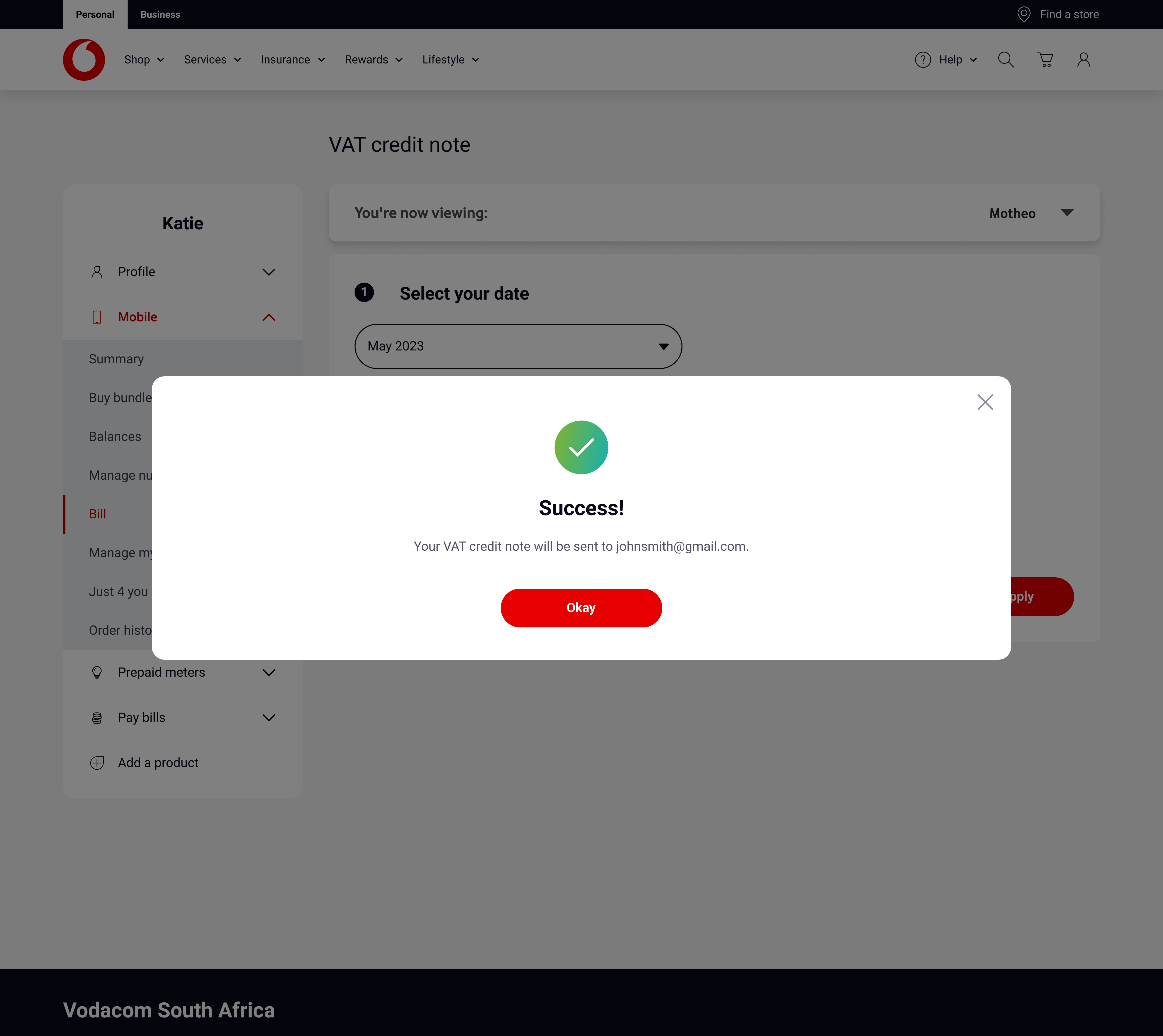

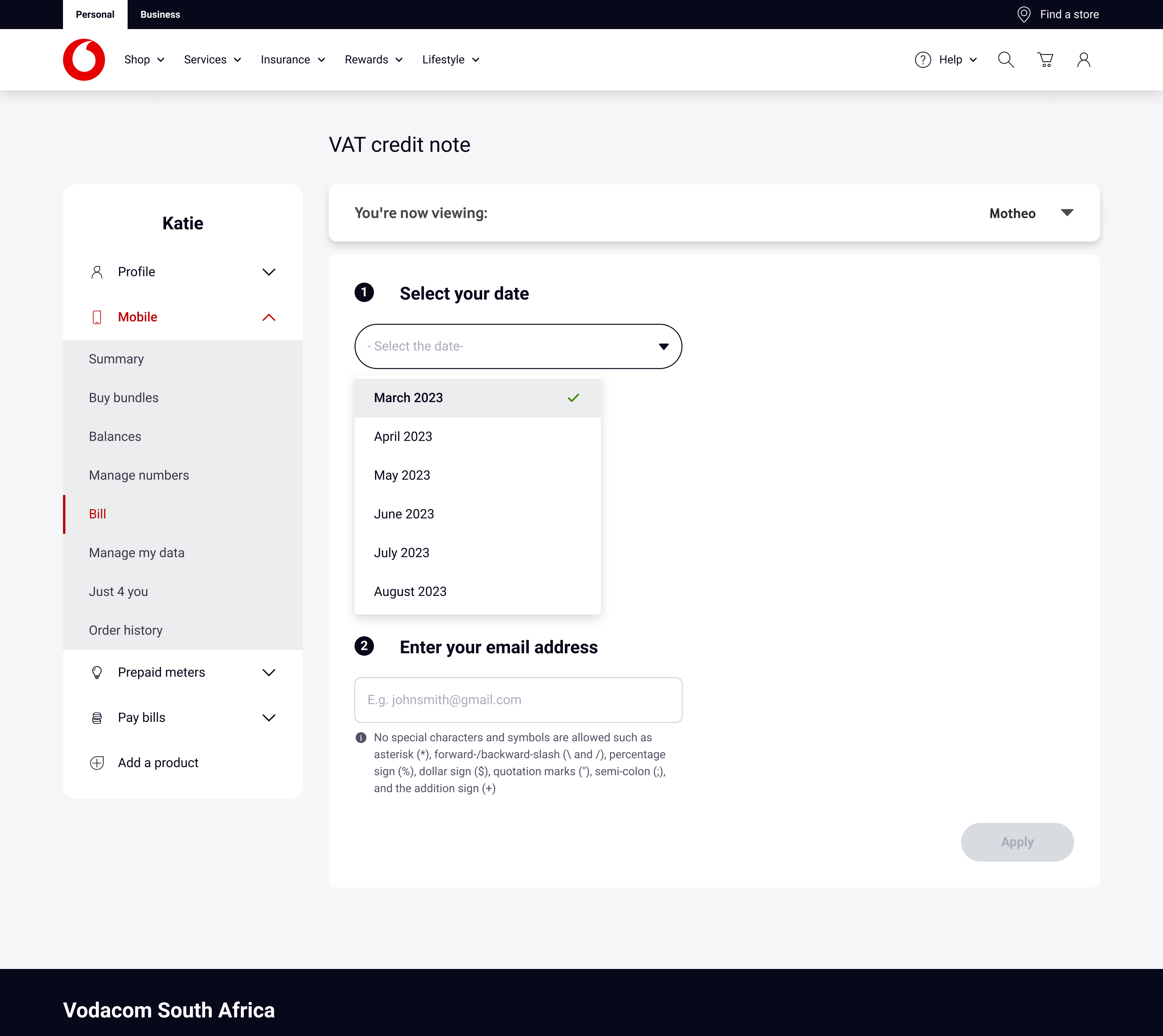

Next, select the date that you want the document for as well as the email address to receive the VAT credit/debit note. Then click 'Apply'.

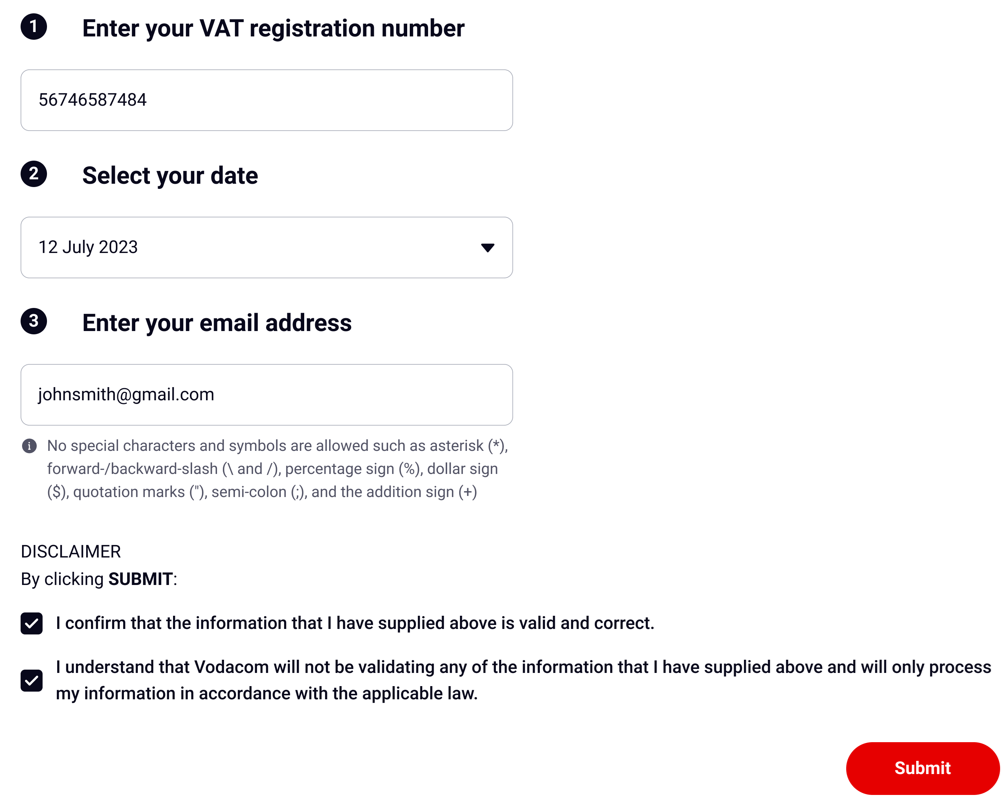

2. VAT Registered Hybrid/Top-up customer with no VAT Registration on file with Vodacom to please note the following:

If you do not have a VAT Registration number on record with Vodacom, you will need to enter your VAT Registration number to be able to request a VAT Credit/Debit note. If you are not registered for VAT the VAT Credit/Debit note is not applicable to you.

Now, complete your VAT registration number and select the date that you want the document for. Next, input the email address and complete the disclamer. Click "submit" to receive the VAT credit/debit note.